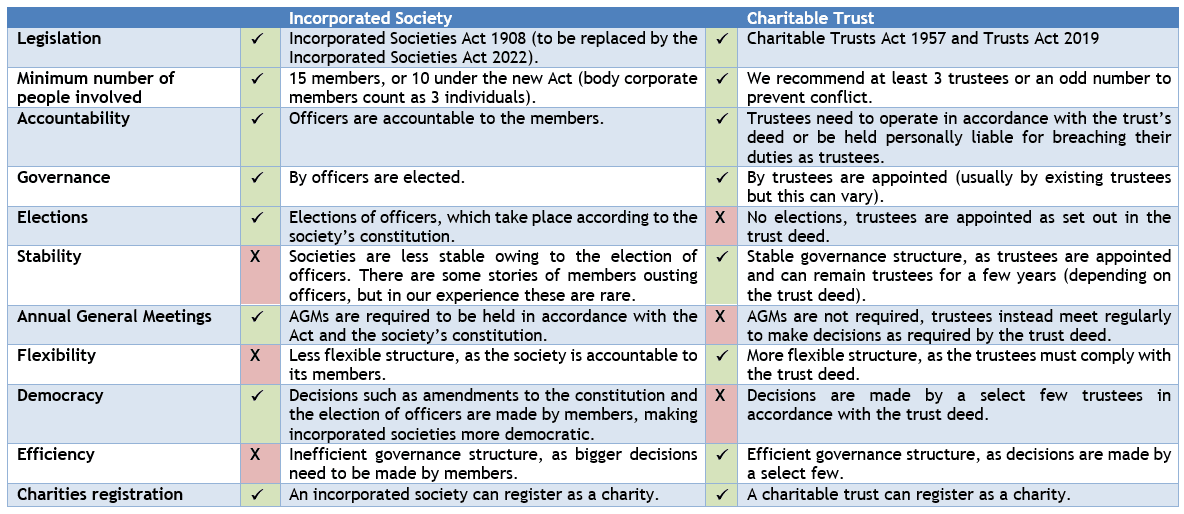

Charitable trusts and incorporated societies are two common legal vehicles for doing good in New Zealand. There is often confusion around the different structures. We have provided a brief summary outlining the benefits and drawbacks of each option below:

This article is not a substitute for legal advice and you should consult your lawyer about your specific situation. Please feel free to contact us at Parry Field Lawyers:

- Steven Moe, Partner – stevenmoe@parryfield.com

- Yang Su, Senior Solicitor– yangsu@parryfield.com

- Michael Belay, Solicitor – michaelbelay@parryfield.com

- Sophie Tremewan, Solicitor – sophietremewan@parryfield.com