Now is a great time to consider whether the legal vehicle of your society is best serving your needs. We’ve outlined the pros and cons of Incorporated Societies and Charitable Trusts as entities here.

If you believe a Charitable Trust is right for you, we can help you transition from an incorporated society. The process if relatively straightforward but can take some time. A few key points to consider are:

- Bequests – have you received many bequests in the past? Once your current incorporated society is wound up, there is a chance that a bequest meant for you may not find its way to the new entity. There are ways to help prevent this (e.g. notifying key stakeholders that they should update their will, keeping the same charities services number or even keeping the society as a shell for a period of time), but it is still a risk.

- Employees – if you have any employees, you need to make sure you engage with them throughout the process and give them time to consider the change. We have a specialist employment team who can help you throughout this process.

- Contracts – you will need to move any contracts across to the new entity and inform key stakeholders of the change – this can take time. If you own any property, this would need to be transferred too. We and our specialist property team could assist throughout this process.

- IRD and Charities Services numbers – you will need to apply for a new IRD number. If you have tax donee status, this will need to transition from the society to the charitable trust. The good news is you can keep your number with Charities Services despite moving to a different type of entity.

- Taking people on the journey with you – it’s so important to take members and stakeholders on the journey with you. This means it can take some time to transition, but is well worth it when it comes time to vote.

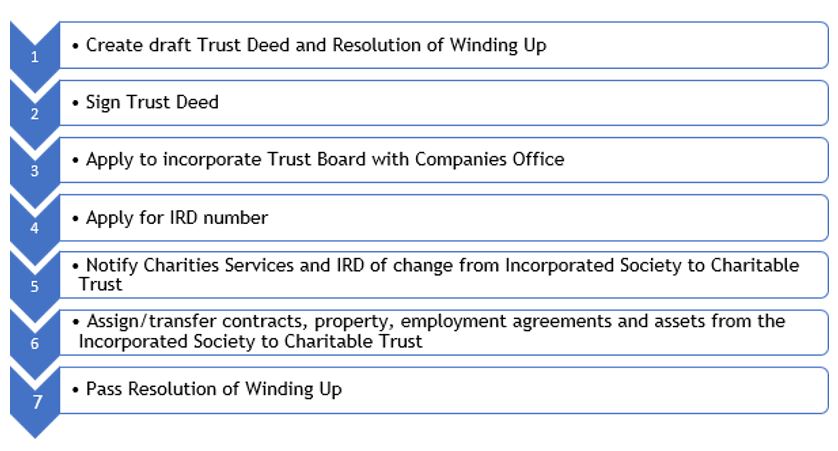

Here’s what the transitioning process would look like:

Parry Field Lawyers could help with each step of the process. If you would like to find out more, get in touch to arrange a call or meeting.

This article is not a substitute for legal advice and you should consult your lawyer about your specific situation. Please feel free to contact us at Parry Field Lawyers:

- Steven Moe, Partner – stevenmoe@parryfield.com

- Yang Su, Senior Solicitor– yangsu@parryfield.com

- Michael Belay, Solicitor – michaelbelay@parryfield.com

- Sophie Tremewan, Solicitor – sophietremewan@parryfield.com