Most people have heard of incorporated societies, but what about unincorporated societies? In reality, there are thousands of unincorporated societies in New Zealand. They might be sporting groups, hobby groups, community groups, or a group set up for a particular purpose.

Incorporated societies are, as their name suggests, ‘incorporated’. A key benefit of incorporation is that society members are generally not personally responsible for any of the society’s obligations. They become incorporated by registering with the Companies Office and they need to follow the legal obligations set out in the Incorporated Societies Act 2022 and the Charitable Trusts Act 1957.

Unincorporated societies, on the other hand, are typically much less formal, and this comes with advantages and disadvantages. Let’s look at some examples.

Disadvantages relate to the fact that liability can attach to members and the inability to own property:

- Limited Legal Status: Unincorporated societies (as opposed to incorporated societies) do not have a separate legal personality. This means they cannot enter into contracts, own property, or sue or be sued in their own name. Individual members may be personally liable for the society’s debts and obligations.

- Limited Liability Protections: While members typically have limited liability, their personal assets may still be at risk in the event of legal disputes or financial problems within the society, depending on the circumstances.

- Difficulty in Holding Assets: Unincorporated societies cannot own assets in their own right. Any assets are usually held in the names of individual members or office bearers, which can make asset management and ownership more complex.

- Limited Funding Opportunities: Unincorporated societies may face challenges when seeking funding or applying for grants from certain organizations or government agencies, as some may prefer to work with registered legal entities for accountability and transparency reasons.

- Less Credibility: Compared to incorporated entities, unincorporated societies may be perceived as less credible or less established, which could impact their ability to attract members, volunteers, or supporters.

- Limited Access to Legal Remedies: Unincorporated societies may have limited access to legal remedies and dispute resolution mechanisms compared to registered legal entities.

- Dissolution Challenges: If an unincorporated society decides to dissolve, distributing assets and resolving financial matters can be more complicated than for registered legal entities.

Advantages relate to their simplicity and flexibility:

- Simplicity and Low Cost: Forming and maintaining an unincorporated society is generally straightforward and cost-effective compared to setting up and operating a registered legal entity like a company or charitable trust. There are minimal legal formalities and registration requirements.

- Flexibility: Unincorporated societies enjoy a high degree of flexibility in terms of governance, decision-making processes, and organisational structure. They can adapt their rules and operations to suit the needs of their members.

- Minimal Reporting Requirements: Unincorporated societies have fewer reporting and compliance obligations compared to incorporated entities. They are not generally required to file annual financial statements with government agencies.

- No Shareholders: Unlike companies, unincorporated societies do not have shareholders, which means there are no ownership interests or equity shares to manage. Members usually have equal rights.

- Tax Benefits: Depending on their purpose and activities, unincorporated societies may be eligible for tax-exempt status, which can result in cost savings for the organization and its members.

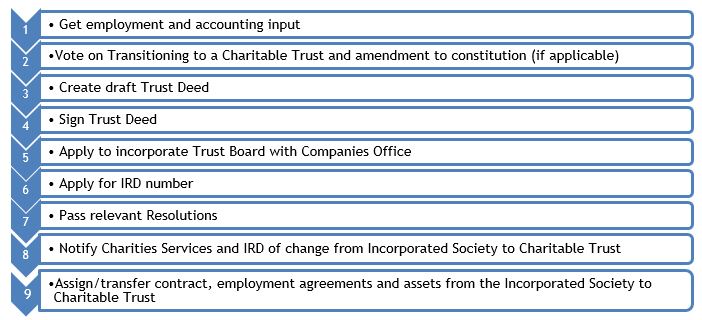

Groups may start out as unincorporated and go on to become incorporated as a way of dealing with the disadvantages. Choosing whether to incorporate or not depends on the group’s goals, size, and activities. Another legal structure such as a charitable trust might be a better option. In this article we compare the two structures.

If you are part of an incorporated society, there are important changes required that you need to be aware of. To help people understand the requirements we have put together an extensive Incorporated Societies Information Hub full of free resources.

This article is general in nature and is not a substitute for legal advice. You should talk to a lawyer about your specific situation. Reproduction is permitted with prior approval and credit being given back to the source.

We help with unincorporated and incorporated societies and answer questions all the time. If you would like to discuss further, please contact one of our team on stevenmoe@parryfield.com, sophietremewan@parryfield.com or annemariemora@parryfield.com at Parry Field Lawyers.