Comments are requested on these regulations by 24 July 2023 at 5pm. We created this summary to help inform you about what you might want to submit on. The regulations set out in the paper are divided into two categories: “Base” and “Top-up” regulations. Both categories are necessary to give effect to purposes of the 2022 Act but Base regulations are considered to be uncontroversial and do not require consideration of other options. The Top-up regulations are matters where there is genuine scope to consider different options, and cover eleven issues.

Base regulations

These regulations include matters such as the form an infringement notice must take, time limits for providing information and how documents in legal proceedings must be served. Also included is what information must be included in certain documents, although further detail is found in the Top-up regulations where the matter required consideration of multiple options as to what would be required.

The regulation regarding the members’ register may be of interest. In addition to current numbers, it must contain the names of former members and the date on which they ceased to be a member. It also clarifies the requirement for having a date when a person became a member of the society: if unknown, the register may state “unknown” instead of a date.

None of the other regulations are likely to be unexpected or to make a material difference to work done in reviewing rules so far.

Top-up regulations

- Officers’ contact details (ss 9, 109, 192, Sch 3, Sch 1):

The proposal is that officers’ names and physical addresses need to be provided, with electronic address optional. Physical address information will not be on the public side of the register but held by the Companies Office in line with the Privacy Act 2020. This is to address concerns about privacy from having physical addresses publicly available, but also allowed the Companies Office to contact officers if required.

- Method of filing (ss 9, 48, 52, 109, 111, 116, 117, 176, 185, 216, Sch 1, Sch 3):

The proposal is that the Register may, having regard to the nature of a society and all relevant circumstances, allow a method other than the designated internet site for communicating and filing of documents. This is to account for societies without technical computer knowledge or internet access and not exclude older, poorer or more rural members.

- Declaring persons not to be officers (s 5):

The proposal is that the definition of “officer” exclude liquidators, receivers and statutory managers. People in these roles were unlikely to be considered officers anyway; this is for clarity. It had been suggested previously that various other positions be excluded from being officers (and thus stop officer duties being owed) but this is no longer proposed.

- Requirement that majority of officers on committee be members (s 45):

The proposal is that societies can become exempt from this requirement for five years from the commencement of the 2022 Act, until 5 October 2028, if they notify the Registrar of their non-compliance. This applies to both societies re-registering and new societies. In this five year period it will be reviewed under what circumstances a society will be allowed to have more than 50 per cent independent officers. The prevailing feedback from previous submissions was that membership should be allowed to exclude the society from the requirement, but at present the Minister feels this would undermine s 45.

- Jurisdictions whose office disqualifications will be recognised (s 47):

The proposal is that if a similar order is made in any jurisdiction, they are disqualified from being an officer of a society in New Zealand. It was considered that this could be hard to check depending on the country, but as officers have to consent in writing that they are eligible this was felt to not be a major issue.

One potential concern is whether this could have an effect on refugees or others from countries where they may have been unfairly disqualified from being an officer.

- Restricting AGM attendance to delegates/representatives (s 84):

Proposal is that societies (excluding unions) with over 1,000 members be allowed to restrict AGM attendance to delegates or representatives of members. Societies that restrict AGM attendance currently but do not exceed 1,000 members will have until 5 October 2028 to comply. This is considered a balance between allowing members their right to attend and preventing administrative unworkability.

- Definition of total current assets (s 103):

Proposal is to align the definition of ‘total current assets’ (for the purposes of determining a ‘small’ society) with that of ‘current assets’ used in International Accounting Standards for Public Benefit Entities. This is to prevent the confusion and uncertainty from having at different definition to an established accounting term.

- Defining societies that will need their financial statements audited (s 105):

Proposal is that societies (that are not registered charities) will be required to have their financial statements independently audited if their operating expenditure in each of the two preceding financial years is over $3 million. This is to capture approximately one per cent of societies, balancing the need for independent oversight with avoiding excessive burdens and costs.

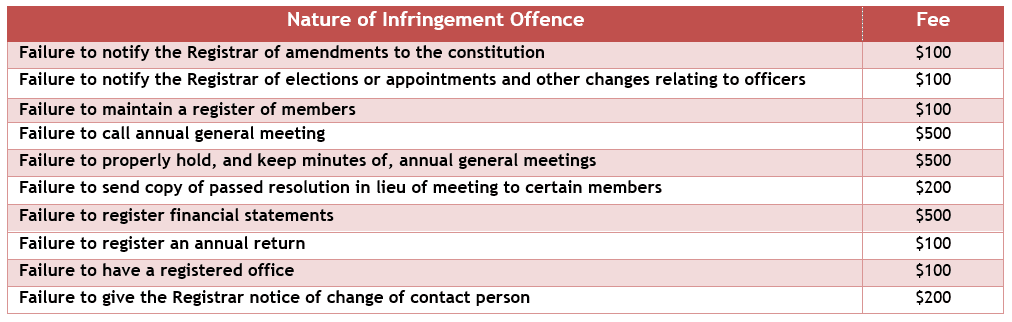

- Setting infringement fees (s 160):

These are set to be in line with the relative seriousness of each offence, while acknowledging that many societies are volunteer-led for community benefit.

For very small societies, these fees could add up very quickly and be quite significant. If multiple offences occur at once, perhaps there could be a cap or some discretion allowed.

The proposed fees are as follows:

- Persons Registrar must notify when intending to remove a society (s 177):

The proposal is that, along with Inland Revenue and Charities Services, the Registrar must notify both the contact person(s) of the society and the society via its registered office. Submissions indicated that just the contact person was not enough. This provides two avenues for contact, giving a greater chance of the society becoming aware of potential removal.

Considering the requirement of having officers’ contact details, it would seem simple enough to notify each officer, particularly if an email address is recorded. Having officers’ details would allow this sort of communication. There may be societies where the contact person and the office address are the same. If this person has had any communication issues or been slack, communication to other officers may allow alert them to the issue.

- Entities formed or incorporated by other Acts that may convert to an incorporated society (s 257, Sch 3):

Entities established under the New Zealand Library Association Act 1939 and the Libraries and Mechanics’ Institutes Act 1908 are covered by the provisions.

The paper contains discussion on the impact of the regulations and why these regulations were considered over other options.

The full document can be found here: https://www.mbie.govt.nz/dmsdocument/26944-incorporated-societies-act-2022-proposed-regulations-proactiverelease-pdf

—

If you have any further queries please do not hesitate to contact one of our experts at Parry Field Lawyers- stevenmoe@parryfield.com, yangsu@parryfield.com, sophietremewan@parryfield.com, michaelbelay@parryfield.com or annemariemora@parryfield.com

This article is general in nature and is not a substitute for legal advice. You should talk to a lawyer about your specific situation. Reproduction is permitted with prior approval and credit being given back to the source.