The Limited Partnership regime was introduced fairly recently in New Zealand through the Limited Partnership Act 2008. As such, limited partnerships may not be as familiar to Kiwi entrepreneurs and founders. In this article, we highlight a few of the advantages and disadvantages of choosing a limited partnership for your business structure. In our view, they represent a relatively simple structure which can really be useful in the right situation.

What is a Limited Partnership?

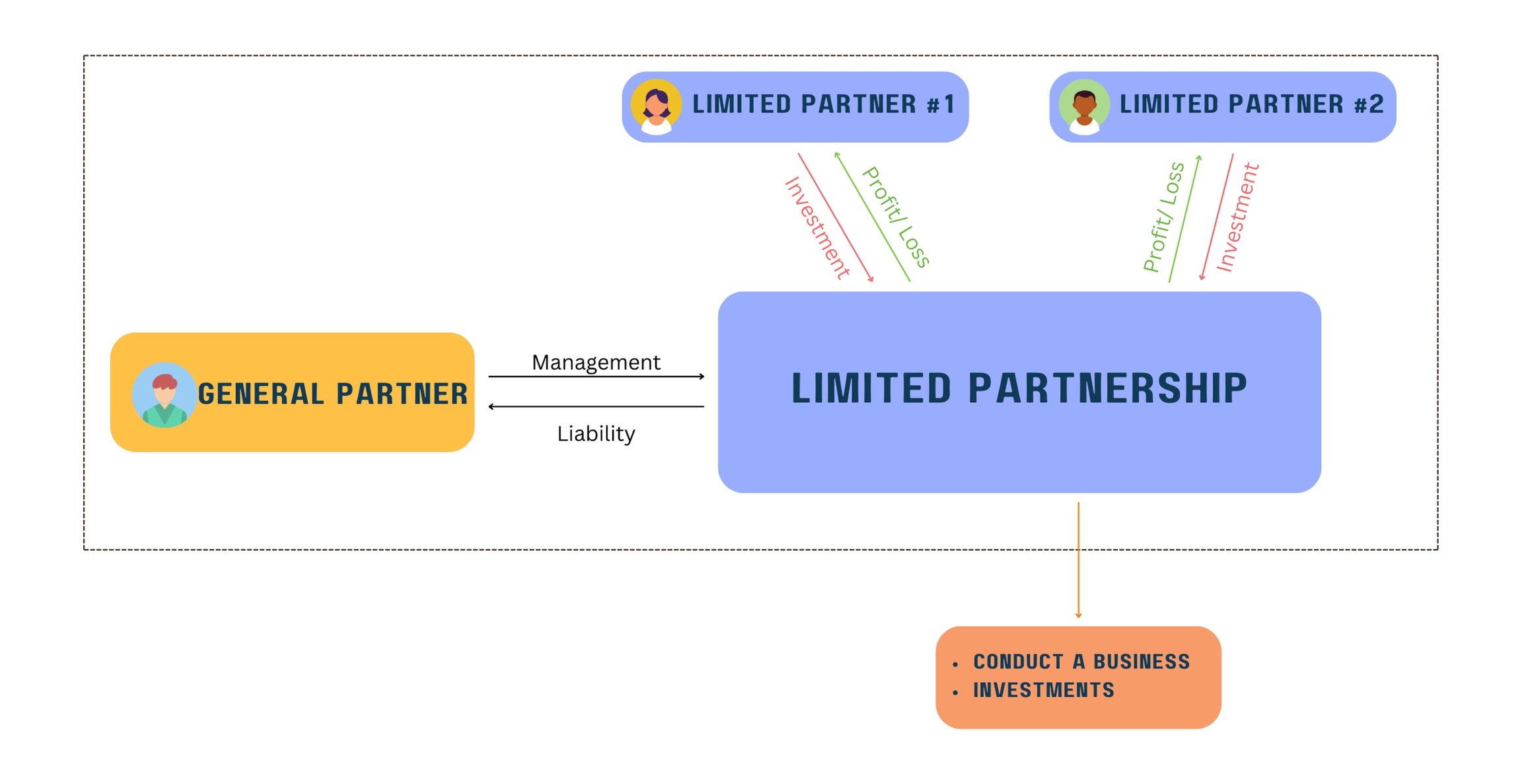

Limited partnerships are a corporate structure that combine some key features of companies (such as separate legal personality) and partnerships (such as tax pass-through treatment). In a limited partnership, on entity is the general partner(s) who manage(s) the limited partnership (day to day running) while other investors are limited partners who act as silent partners (see diagram below).

This structure is often used by venture capitalists or fund managers as the corporate vehicle for investor partners to invest their funds. For more information on the basic requirements of a limited partnership, along with a comparison of other structures, please see here.

Why choose a Limited Partnership?

| Positive | Comment |

| Liability is ring-fenced | A limited partnership is a separate legal entity, and limited partners’ liability is restricted to contributed capital |

| Effective practical and legal control | Only general partners may manage the affairs of the limited partnership |

| Tax pass-through treatment | Tax consequences of the limited partnership pass directly to the partners |

| Privacy | Identity of limited partners and contents of partnership agreement do not have to be publicised |

Why wouldn’t I choose a Limited Partnership?

| Drawback | Comment |

| General partner is jointly liable with the limited partnership for the liabilities of the limited partnership | Often addressed by choosing a limited liability company to act as general partner, providing liability ring-fencing |

| More involved set-up | All limited partnerships require a written partnership agreement |

| Investors negotiate their rights and obligations | E.g. Right to remove/appoint general partner(s), exit rights, pre-emptive rights |

| Financial Markets and Conducts Act 2013 | A partnership interest in a limited partnership may be a financial product requiring FMCA compliance |

We have helped many founders and companies structure their business and each situation is unique. If you think a limited partnership may be a suitable option for your business, feel free to reach out if you would like specific input on your context.

If you enjoyed this content then we also have a guide for people doing business in New Zealand which you can download for free here.